The Kazakhstan Bitcoin Project

Background

Sourcing a location and securing an electricity supply for a new Bitcoin mining project in Kazakhstan.

Abdumalik Mirakhmedov wanted to start a Bitcoin mining project. In 2016, he approached the founders of the global crypto mining conglomerate, Marco Streng and Marco Krohn of Genesis Mining Limited, with a proposal to create a joint venture in Kazakhstan. He also brought his Kazakh business partners Rashit Makhat and Andrey Kim (all three collectively known as MMK) into the project.

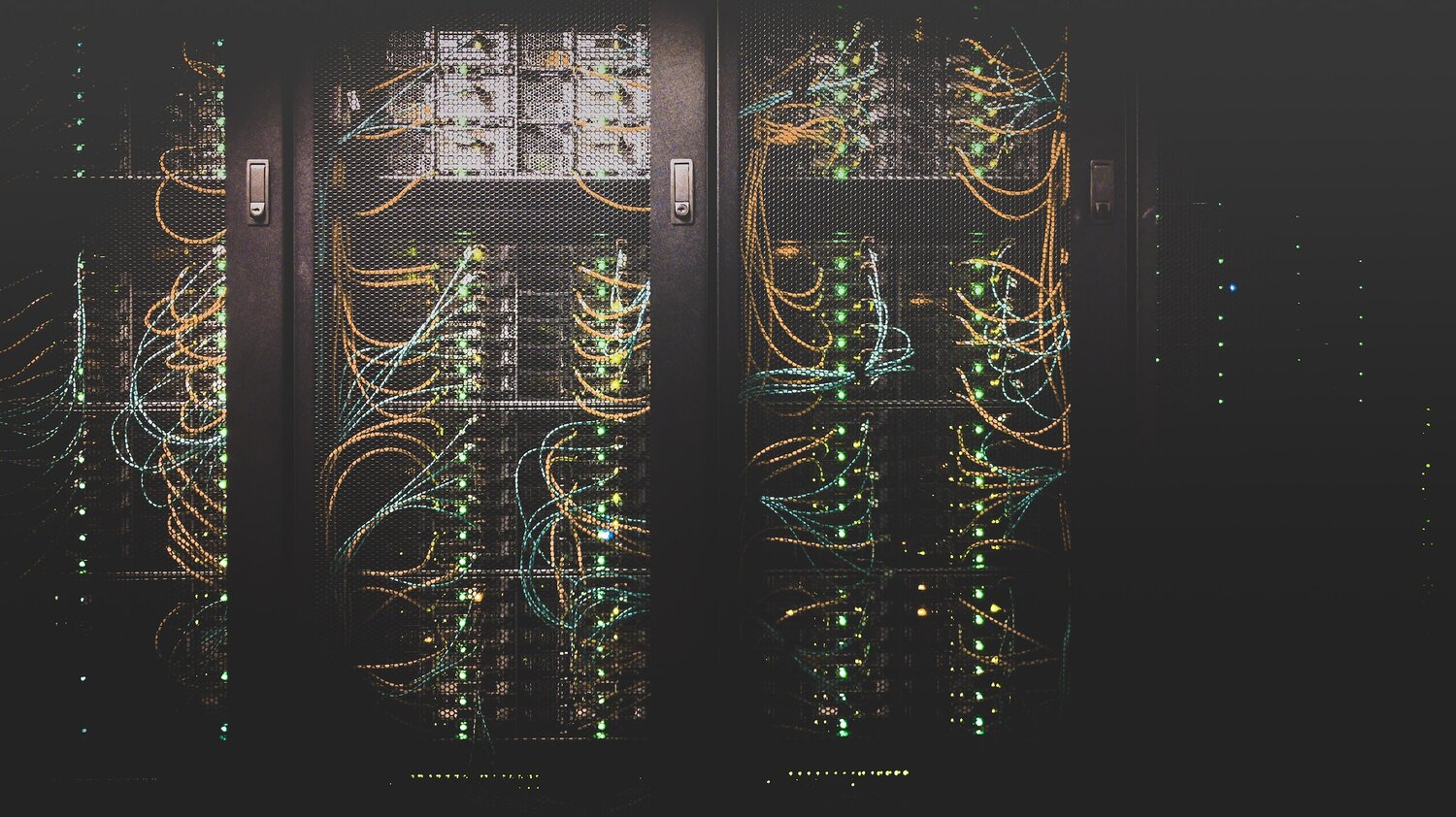

In the first quarter of 2017, MMK and Genesis Mining Limited entered into a 50/50 partnership in a new Kazakhstan bitcoin project - the joint venture Genesis Mining (GM JV). MMK was responsible for finding a site for the project, as well as finding a source of electricity of up to 100 MW, the price of which does not exceed 4 cents per kW for mining farms, and Genesis Mining provided the Bitcoin mining technology and equipment.

Kazakhstan, with its climate and cheap electricity, seemed like an ideal place to implement the project. The missing element for MMK was to find an energy source with a capacity of up to 100 MW, purchase it at a competitive price and prepare a location for the mining farm. According to the agreement, Genesis Mining was ready to supply the necessary equipment within the agreed time frame.

MMK's obligatory condition under the agreement with Genesis Mining was to ensure uninterrupted power supply at the test site they had already chosen in the city of Astana (which belonged to one of MMK). There, together with Genesis Mining, in the first quarter of 2017, they already launched an experimental crypto-farm with a capacity of 1 MW, for which they were forced to purchase electricity at 5 (!) cents per kW, having equipped one of the existing workshops for this. And in place of other free areas, they planned to further increase the farm's capacity to 100 MW.

However, MMK was unable to provide electricity supply. Thus, the successful continuation of the project was in jeopardy and MMK was forced to turn to third parties for help.

In May 2017, MMK turned to Yermek Alimov, who has extensive experience in the energy sector of Kazakhstan, and asked him to intervene to save the project, to which he agreed. Alimov played a decisive role in the launch of the GM JV mining project, redirecting his experience and assets to support MMK's obligations to Genesis Mining.

Realizing that placing a crypto-farm in Astana could cause damage to the population and business of the capital, despite the insistence of MMK, Alimov proposed directing efforts to place breaded crypto-farms in energy-rich regions (for example, Pavlodar, Karaganda or East Kazakhstan regions), where there is an opportunity resolve the issue without shocking people. MMK agreed with these plans and accepted Alimov into the project.

According to their agreement, Alimov pledged to ensure that GM JV received up to 100 MW of power and that the electricity costs stayed below $0.04 per kWh. Alimov guaranteed that this would be achieved by negotiating the purchase of suitable power stations for MMK to buy. He also agreed to provide his own assets, if necessary, such as an electrical substation and industrial base that he owned in the Karaganda region.

In exchange for his contribution, Alimov was promised 35% of the 50% shares owed to MMK in the future holding company; the equivalent share of bitcoins generated by the project; the difference between the cost of electricity at 4 cents per kWh and the real price.

Alimov and MMK agreed on these conditions in the UK – at Mirakhmedov's London residence.

FTX Involvement

In August 2021, the venture capital arm of FTX cryptocurrency exchange, Alameda Research started making substantial investments in GDA, with an initial capital injection of about $100 million. Following this FTX's founder, Sam Bankman-Fried joined the GDA board in October 2021, marking a closer alignment between the two companies, which was followed by further investments in 2022:

August 2021: Alameda Research $100 million investment into GDA

January 2022: Alameda Research $550 million investment into GDA

February 2022: Alameda Research $250 million investment into GDA

April 2022: Alameda Research $250 million investment into GDA

Alameda Research's total investment into GDA is:

$1.15 billion

Following this investment GDA's valuation reached:

$5.5 billion*

Mounting questions around FTX and Alameda Research's financial practices led to Sam Bankman-Fried stepping down from the GDA board in November 2022. The scrutiny on FTX intensified when CoinDesk published an article that shed light on Alameda Research's dependency on FTX's digital token, FTT, revealing that Alameda had $5 billion worth of assets tied up in FTT. A leaked FTX balance sheet showed $9 billion in liabilities against only $900 million in assets, showing a possible $8 billion deficit, and that FTX's assets were significantly lower than Bankman-Fried had previously stated.

Weakened by a liquidity shortage and a surge of withdrawals, FTX collapsed in November 2022, with GDA remaining one of the largest assets in the FTX bankruptcy process.

New FTX CEO John J. Ray III described FTX's $5 billion investment portfolio, including its $1.15 billion investment in GDA, as a "recovery pool for our clients." At the end of October 2023, a jury in Manhattan federal court found Sam Bankman-Fried guilty of all charges, during which it was proven that he stole $8 billion from clients of the exchange. This may also mean that during the bankruptcy process, certain claims may arise against the recipients of this money.

Why Kazakhstan?

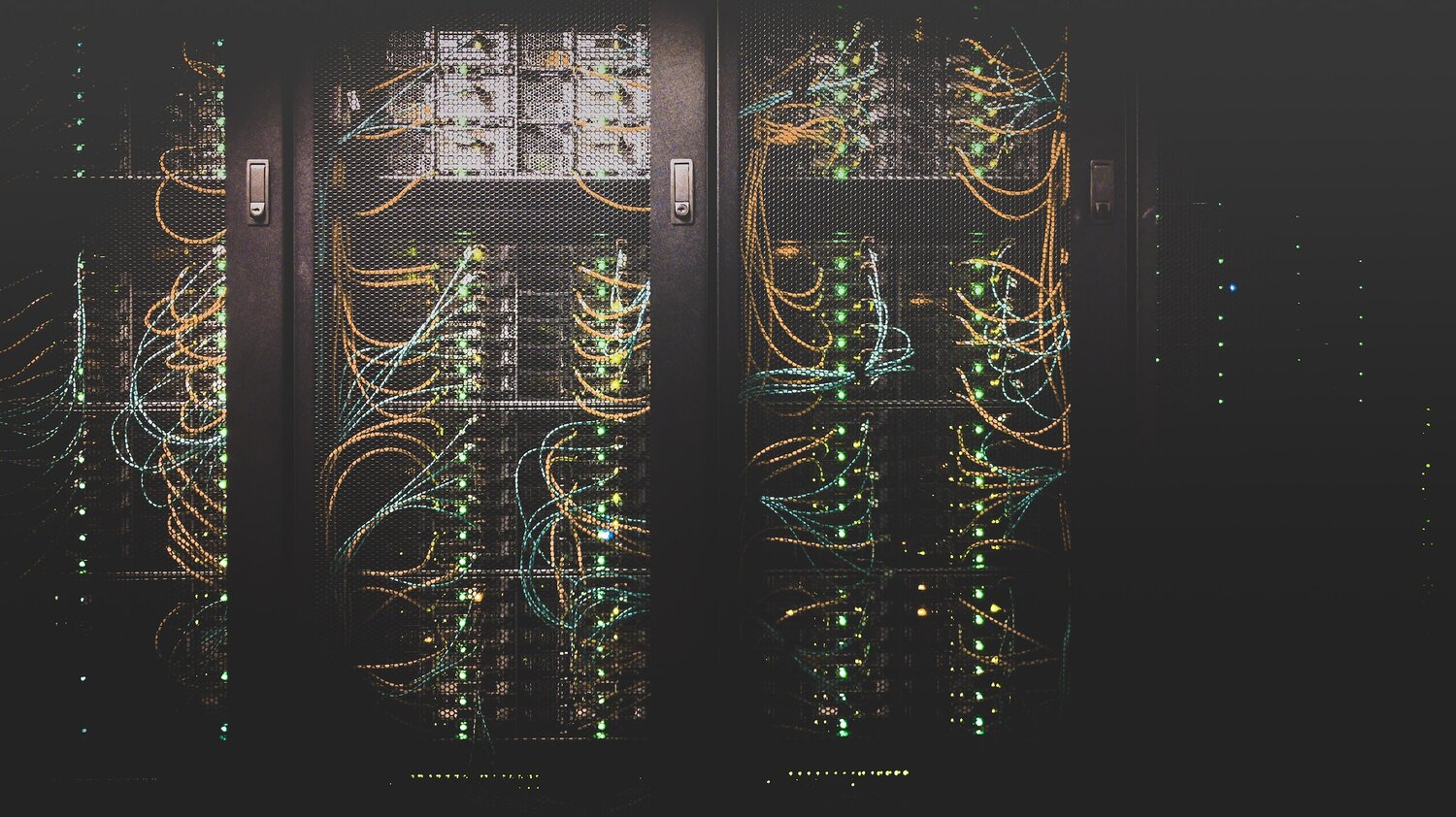

Kazakhstan's cryptocurrency industry has seen huge growth since 2017. Investors flocked to Kazakhstan and it became the second-largest Bitcoin mining market by mid-2021, behind the US.

For GDA, Kazakhstan has become the most profitable place to do business:

The cost of mining 1 bitcoin on all GDA farms around the world was $9,000

But in Kazakhstan, the cost of mining 1 bitcoin was 50% cheaper - $4,500

Favorable conditions have made Kazakhstan an ideal location for cryptocurrency mining, combining abundant land, accessible electricity supply and a cold climate, resulting in the process being extremely cheap and attractive to investors.